az auto sales tax

County tax can be. City Hall Offices are open Monday - Friday from 730 am.

Used Az Auto Sales Llc For Sale With Photos Cargurus

The current statewide sales tax in Arizona is 56.

. There are a total of 99 local tax jurisdictions across the. Price of Accessories Additions Trade-In Value. Sales Tax Rate Chart.

The date that you. A state use tax or other excise tax rate applicable to vehicle. The minimum combined 2022 sales tax rate for Flagstaff Arizona is.

This is the total of state county and city sales tax rates. The Arizona sales tax rate is currently. The County sales tax.

302 rows 8008 Arizona has state sales tax of 56 and allows local governments to collect a local option sales tax of up to 53. Ad Looking for arizona sales tax on cars. Complete a sold notice on AZ MVD Now.

Arizona Department of Revenue Vehicle Use Tax and Calculator Questions and Answers April 2020 If you recently purchased a vehicle from an out-of-state. Tax Paid Out of State. Content updated daily for arizona sales tax on cars.

The minimum combined 2022 sales tax rate for Laveen Arizona is. Register with the State of Arizona. The make model and year of your vehicle.

Most businesses pay the. Sign off the back of the title and have your signature notarized. In Arizona the sales tax for cars is 56 but some counties charge an additional 07.

Arizona has several transaction privilege taxes including a use tax local option sales taxes an aircraft use tax residential rental and peer-to-peer car rental taxes. The information you may need to enter into the tax and tag calculators may include. There is no county use tax in.

How Much Is the Car Sales Tax in Arizona. This is the total of state county and city sales tax rates. This documentation should list any sales tax state.

County or local sales tax is specific. The County sales tax. ARIZONA DEPARTMENT OF REVENUE.

Some cities can charge up to 25 on top of that. The vehicle identification number VIN. When combined with the state rate each county holds the following total sales tax.

Overall Arizona statute provides an exemption for the sale of a motor vehicle to a nonresident who is from a state that has both. However the total tax may be higher depending on the county and city the vehicle is purchased in. Sellers use our guide to keep current on all nexus laws and the collection of sales tax.

The Arizona sales tax rate is currently. Arizona AZ Sales Tax Rates by City Sales Tax Table Arizona AZ Sales Tax Rates by City The state sales tax rate in Arizona is 5600. Arizona collects a 66 state sales tax rate on the purchase of all vehicles.

Arizona has a 56 statewide sales tax rate but also. As of 2020 the current county sales tax rates range from 025 to 2. For tax exemption on retail items in the City of Scottsdale the following criteria must be met.

When a vehicle is sold or otherwise transferred you the seller are required to. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Step 1- Know Specific Tax Laws.

Unfortunately the price isnt capped there. However there may be an extra local or county sales tax added onto the base. Ad There are currently more than 12000 state local tax jurisdictions across the 50 states.

All used and new car purchases in Arizona have the statewide sales tax of 56 applied to them. Save time and increase accuracy over manual or disparate tax compliance systems. With local taxes the total sales tax.

Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. When the vehicle is registered with the Arizona Motor Vehicle Division MVD the buyer presents the documents needed to transfer the title. The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience.

1 the order must be placed from outside of Arizona 2 the item is delivered to the buyer outside.

2021 Arizona Car Sales Tax Calculator Valley Chevy

2021 Arizona Car Sales Tax Calculator Valley Chevy

Tax Exemption Vaccination Programme To Support Bermaz S Car Sales

Used Az Auto Sales Llc For Sale With Photos Cargurus

Arkansas Legislators Work To Cut Sales Tax On Used Vehicles

Bermaz Reports Five Fold Jump In 1q Profit As Sales Rose Prior To Expiry Of Sales Tax Exemption The Edge Markets

Used Cars For Sale Tucson Az Used Pickup Trucks Goliath Auto Sales

Big Ticket Items Would Be Exempted From Phoenix Sales Tax Increase

Sales Taxes In The United States Wikipedia

Extra Extra Read All About It Arizona Car Sales Facebook

Used Cars For Sale In Phoenix Az Cars Com

Goliath Auto Sales Used Cars In Tucson

Location Based Reporting Arizona Department Of Revenue

Filing Requirements Arizona Department Of Revenue

Car Tax By State Usa Manual Car Sales Tax Calculator

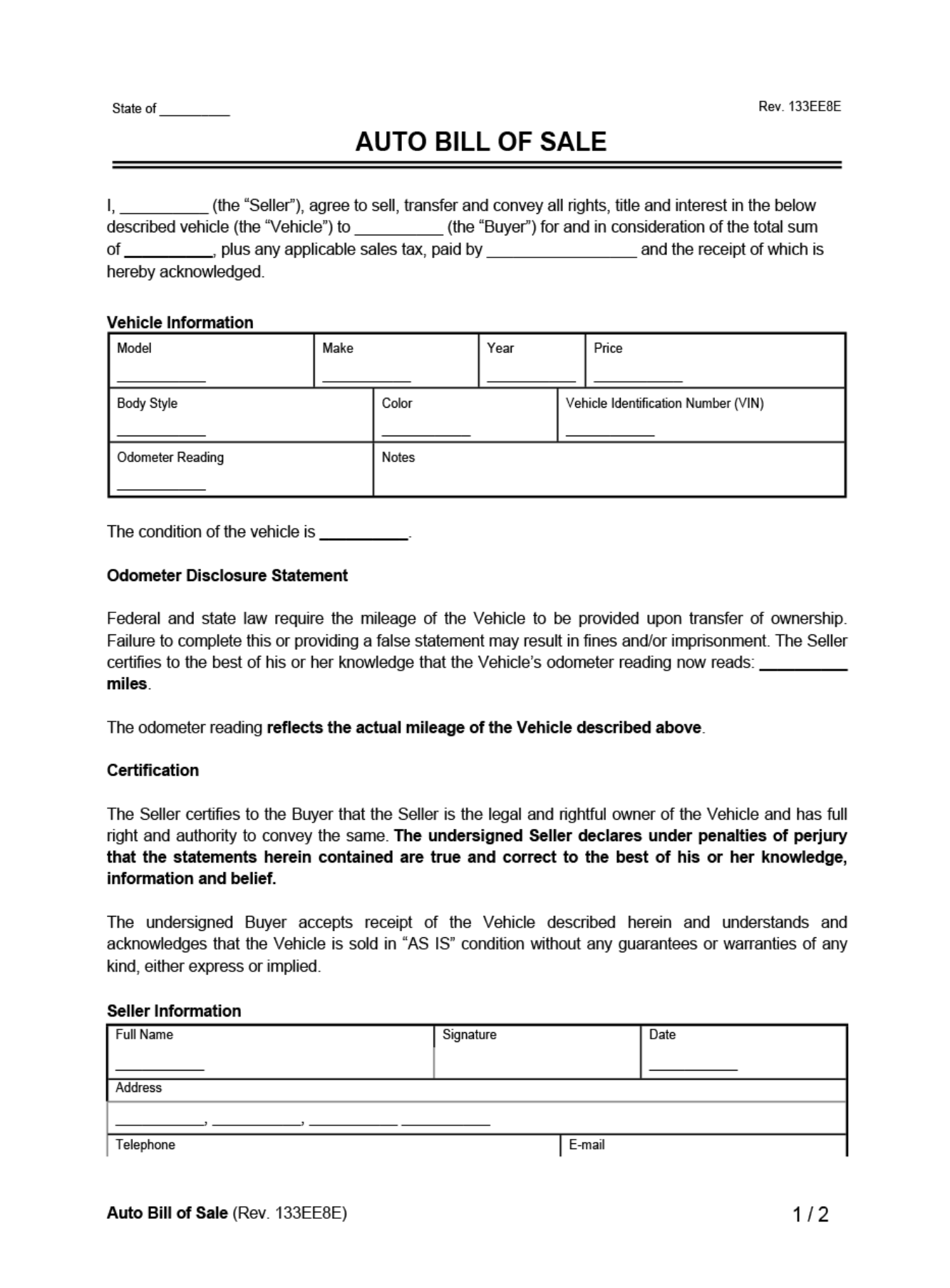

Get Arizona Auto Bill Of Sale Form Usedautobillofsale Com

Your Top Vehicle Registration Questions And The Answers Adot